WhatsApp)

WhatsApp)

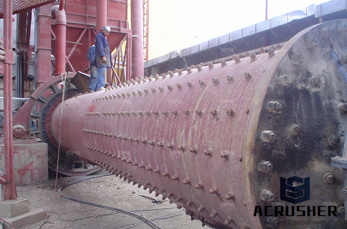

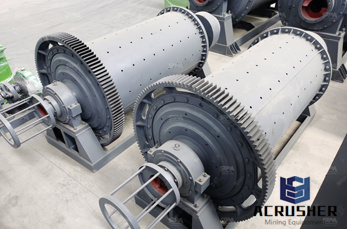

Mining Equipment Depreciation Lives. useful life of mining equipment Grinding Mill ... depreciation rate applicable to crusher units .

2015 Cost Index Depreciation Schedules North Carolina Department of Revenue Local Government Division Property Tax Section. ... equipment, acquired in 2009.

In accountancy, depreciation refers to two aspects of the same concept: The decrease in value of assets (fair value depreciation) The allocation of the cost of assets ...

Discussion Papers no. 840 Expected service lives and depreciation profiles for capital assets Evidence based on a survey of Norwegian firms

Financial Accounting Manual for ... Maximum useful lives for furniture and equipment asset groupings ... and begin depreciation when the equipment is placed into ...

Depreciation of property, plant and equipment . The carrying amounts of property, plant and equipment (including initial and any subsequent capital expenditure) are ...

: Addendum to Schedule A – Energy Efficiency Equipment and Products. The following schedule is based on the American Society of Heating, Refrigeration and ...

Table List of depreciation rates under the new asset code classification — Other machinery and equipment (continued), oil and gas exploration, mining ...

Manual Transmittal July 26, 2016. Purpose (1) This transmits revised IRM, Financial Accounting, Property and Equipment Accounting.

Accelerated depreciation; ... Effective life of intangible depreciating assets that are mining, ... Guide to depreciating assets 2014

Home > Solutions > calculating depreciation of mining equipment. ... Expenditures for new facilities or equipment and expenditures that extend the useful lives of ...

AMORTIZATION AND DEPRECIATION OF MINING ASSETS: Mining assets, mine development and evaluation costs, and mine plant facilities are amortized over the life .

Mining Toolbox Life Cycle Costing Application. Including Haul Trucks, Hydraulic Shovels, Electric Shovels, Bulldozers, Graders, Wheel Loaders and Wheel Dozers

Mining Equipment Depreciation Lives – depreciation rate applicable to crusher units. 1 day ago The Companies Act 2013 does not give the Rate of Depreciation as ...

MinE 306 Exploration and Valuation Depreciation and Depletion Prefeasibility Studies often are completed prior to having all the information needed or

Depreciation and Amortization in Mining Industry: By Harpreet Sandhu Lecturer College of Management Economic Studies University of Petroleum Energy Studies

Smart owners of a variety of heavy equipment who depreciate and elect to replace when selling must consider a 1031 exchange.

calculating depreciation of mining equipment Depreciation of mines and mining machinery and ... Mining Equipment Depreciation Lives Protable Plant

· calculating depreciation of mining equipment Home » plant ... Rates of Depreciation, Service Lives Mining and oil field ...

recoverable amount of its equipment and mining interests. c) ... Depreciation is allocated based on assumed asset lives. Should the asset life or depreciation rates ...

Whither Tax Depreciation? 515 lives were very short. (This favoritism can be reduced, but not eliminated, by basis adjustments, which allow depreciation

Depreciation is usually a forgotten area that can impact on a company''s bottom line as assets age, capital replacement is not planned or instigated.

Asset ownership life includes economic life, depreciable life, and service life, all of which may be different. These lives are compared with examples.

The MACRS Asset Life table is derived from Revenue Procedure 8756 19872 CB 674. The table specifies asset lives for property subject to depreciation under the ...

WhatsApp)

WhatsApp)